Financial Highlights

- Financial Review FY2025

Amid intensifying inflation, the increase in medical and nursing care reimbursements has proven insufficient, and the already challenging business environment has further deteriorated.

Nevertheless, because medical wear is both consumable and essential, the core market performed steadily through the third quarter of FY2025, led by high-function products. However, although a large project originally scheduled for the fourth quarter was successfully secured, its delivery was deferred to FY2026. As a result, 4Q revenue declined, and overall growth slowed to +3.1%.

In the peripheral markets, revenue increased by +5.7%, supported by growing demand for high value-added patient wear and new account acquisitions in the surgical wear segment. In contrast, the overseas market recorded a significant revenue decline of –15.1%. Given the relatively small scale of overseas sales, delays in bidding for projects that had been rescheduled from the 1st-half to the 2nd-half of FY2025 had a disproportionately large impact on results.

| % Change | ||

|---|---|---|

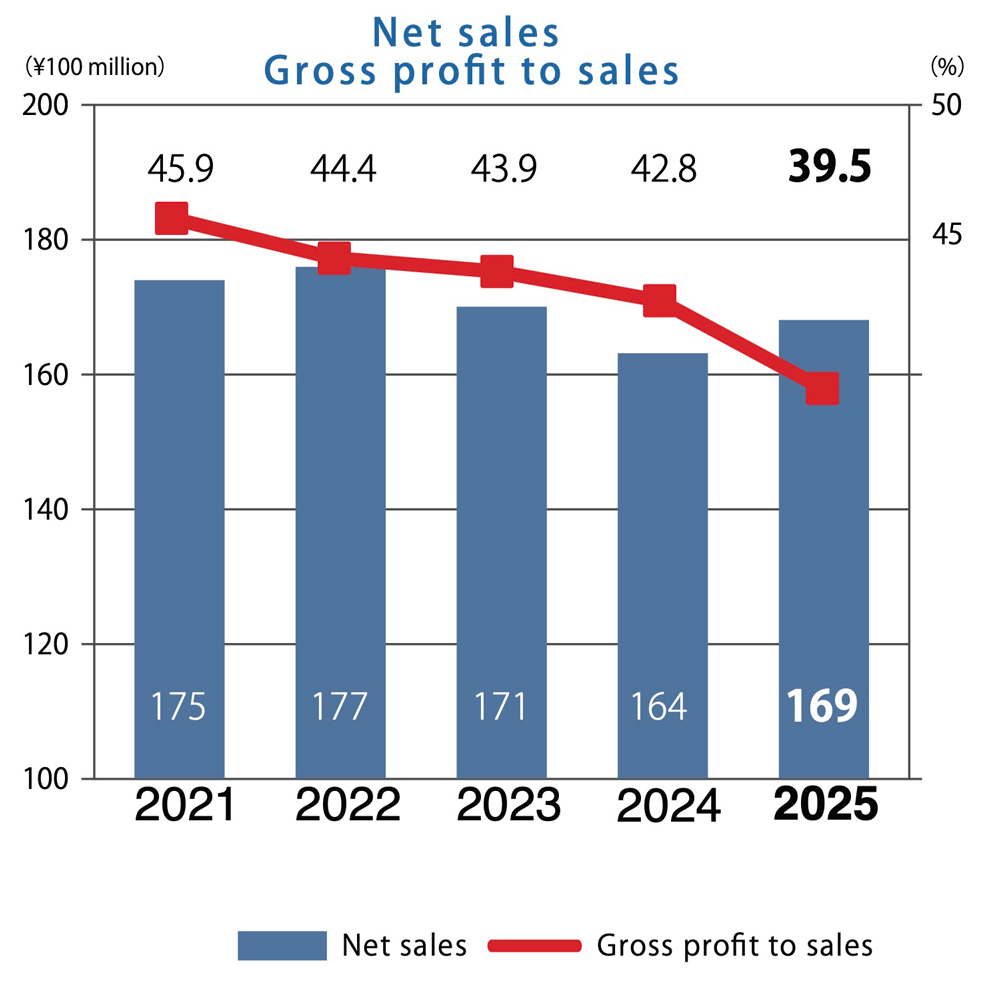

| Net sales | ¥16,983 million | +3.5 % |

| Gross profit to sales | 39.5 % | -3.3 point |

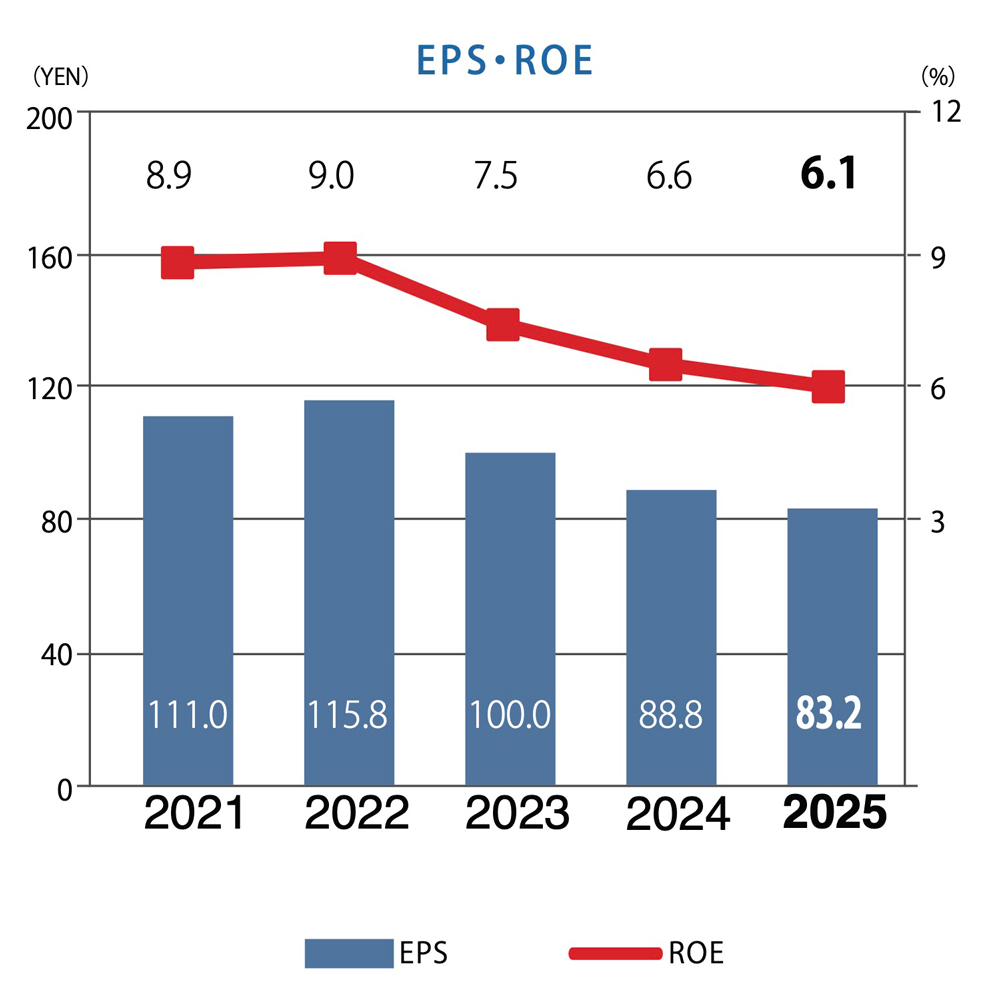

| Operating income | ¥3,583 million | -10.5 % |

| Net income | ¥2,573 million | -8.8 % |

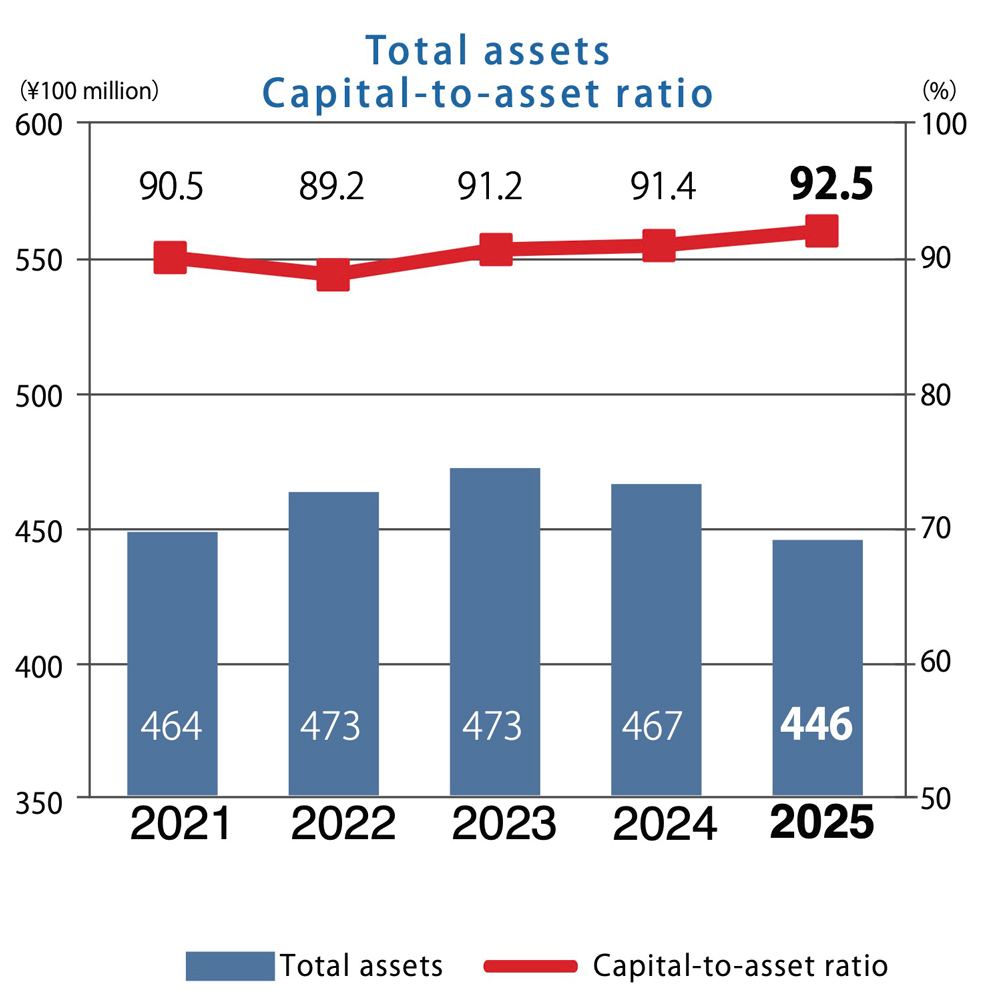

| Total assets | ¥44,692 million | -4.4 % |

| Capital-to-asset ratio | 92.5% |