Financial Highlights

- Financial Review FY2022

The market environment has stabilized with the reclassification of COVID-19 as a category 5 infectious disease, but the management conditions of healthcare institutions have significantly deteriorated due to rising prices associated with inflation and increased labor costs.

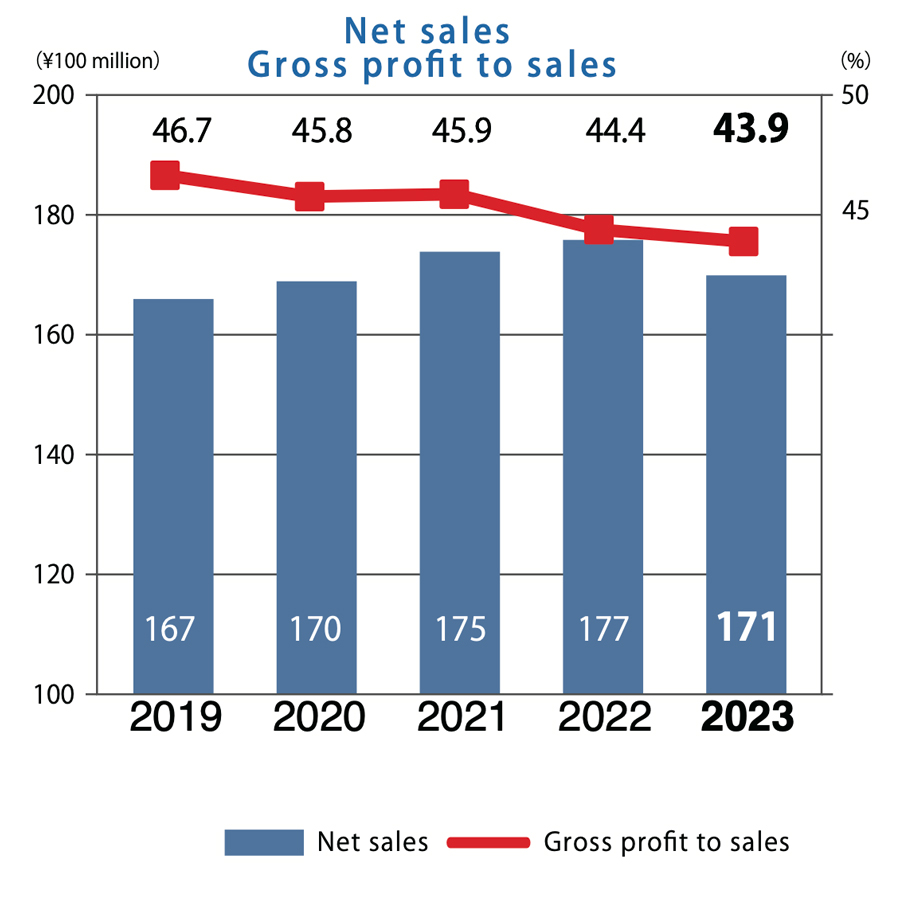

We had been progressing relatively well until 2Q, but following the price adjustments in February, delays primarily occurred in the renewal of core market properties due to the deteriorating market conditions. While we made efforts to catch up in 4Q, ultimately, there was a misalignment in some properties. As a result, our core markets, which are our main focus, experienced a decrease in revenue of 4.5% y/y, resulting in an overall revenue

decline of 3.2% y/y.

| % Change | ||

|---|---|---|

| Net sales | ¥17,181 million | -3.2 % |

| Gross profit to sales | 43.9 % | -0.5 point |

| Operating income | ¥4,604 million | -8.5 % |

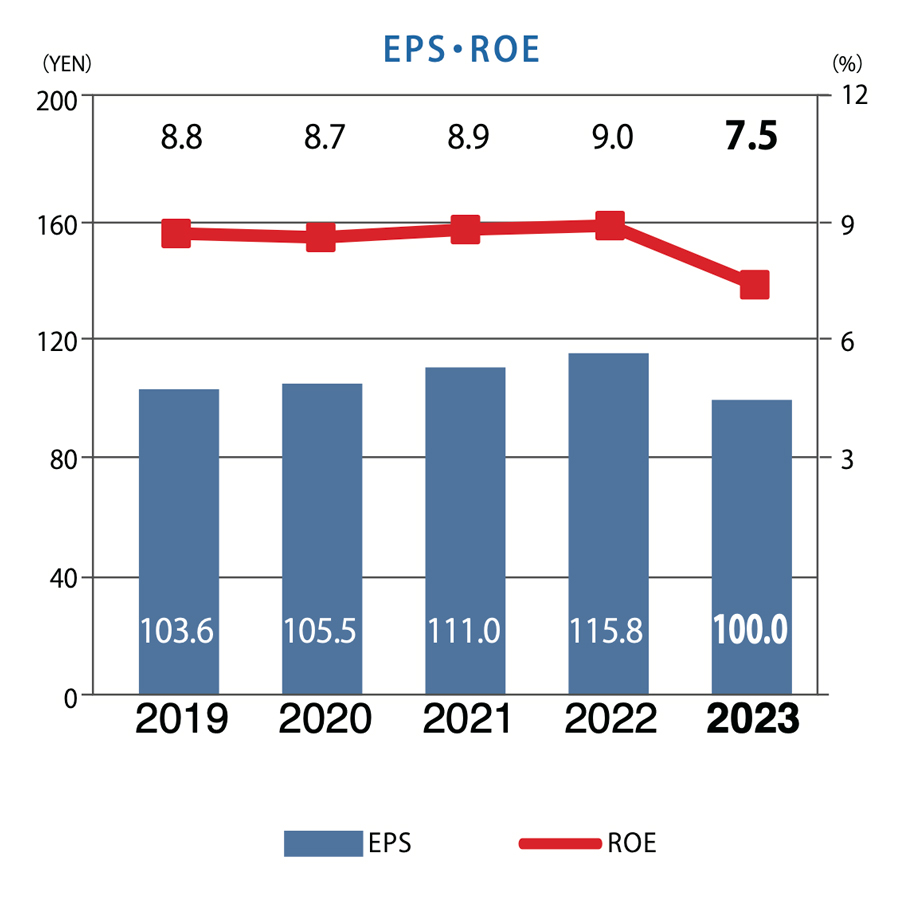

| Net income | ¥3,226 million | -14.6 % |

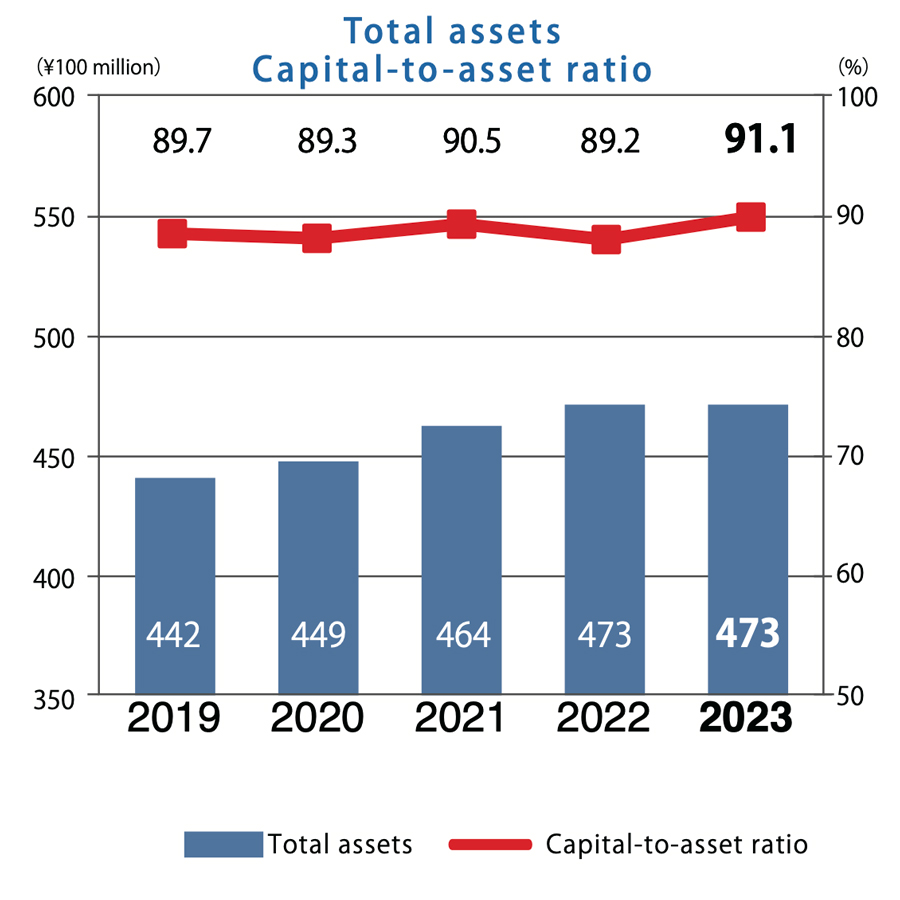

| Total assets | ¥47,377 million | +0.1 % |

| Capital-to-asset ratio | 91.1% |